A tax is a financial charge or other levy imposed on an individual or a legal entity by a state or a functional equivalent of a state (for example, secessionist movements or revolutionary movements). Taxes are also imposed by many subnational entities. Taxes consist of direct tax or indirect tax, and may be paid in money or as its labour equivalent (often but not always unpaid). A tax may be defined as a "pecuniary burden laid upon individuals or property to support the government […] a payment exacted by legislative authority."[1] A tax "is not a voluntary payment or donation, but an enforced contribution, exacted pursuant to legislative authority" and is "any contribution imposed by government […] whether under the name of toll, tribute, tallage, gabel, impost, duty, custom, excise, subsidy, aid, supply, or other name."[1]

In modern taxation systems, taxes are levied in money, but in-kind and corvée taxation are characteristic of traditional or pre-capitalist states and their functional equivalents. The method of taxation and the government expenditure of taxes raised is often highly debated in politics and economics. Tax collection is performed by a government agency such as Canada Revenue Agency, the Internal Revenue Service (IRS) in the United States, or Her Majesty's Revenue and Customs (HMRC) in the UK. When taxes are not fully paid, civil penalties (such as fines or forfeiture) or criminal penalties (such as incarceration)[2] may be imposed on the non-paying entity or individual.

History

Taxation levels

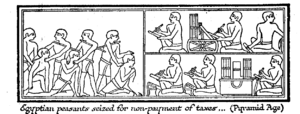

The first known system of taxation was in Ancient Egypt around 3000 BC - 2800 BC in the first dynasty of the Old Kingdom.[10] Records from the time document that the pharaoh would conduct a biennial tour of the kingdom, collecting tax revenues from the people. Early taxation is also described in the Bible. In Genesis (chapter 47, verse 24 - the New International Version), it states "But when the crop comes in, give a fifth of it to Pharaoh. The other four-fifths you may keep as seed for the fields and as food for yourselves and your households and your children." Joseph was telling the people of Egypt how to divide their crop, providing a portion to the Pharaoh. A share (20%) of the crop was the tax.

In India, Islamic rulers imposed jizya starting in the 11th century. It was abolished by Akbar. Quite a few records of government tax collection in Europe since at least the 17th century are still available today. But taxation levels are hard to compare to the size and flow of the economy since production numbers are not as readily available. Government expenditures and revenue in France during the 17th century went from about 24.30 million livres in 1600-10 to about 126.86 million livres in 1650-59 to about 117.99 million livres in 1700-10 when government debt had reached 1.6 billion livres. In 1780-89 it reached 421.50 million livres. [11] Taxation as a percentage of production of final goods may have reached 15% - 20% during the 17th century in places like France, the Netherlands, and Scandinavia. During the war-filled years of the eighteenth and early nineteenth century, tax rates in Europe increased dramatically as war became more expensive and governments became more centralized and adept at gathering taxes. This increase was greatest in England, Peter Mathias and Patrick O'Brien found that the tax burden increased by 85% over this period. Another study confirmed this number, finding that per capita tax revenues had grown almost sixfold over the eighteenth century, but that steady economic growth had made the real burden on each individual only double over this period before the industrial revolution. Average tax rates were higher in Britain than France the years before the French Revolution, twice in per capita income comparison, but they were mostly placed on international trade. In France, taxes were lower but the burden was mainly on landowners, individuals, and internal trade and thus created far more resentment.[12]

Taxation as a percentage of GDP in 2003 was 56.1% in Denmark, 54.5% in France, 49.0% in the Euro area, 42.6% in the United Kingdom, 35.7% in the United States, 35.2% in The Republic of Ireland, and among all OECD members an average of 40.7%.[13][14]

Forms of taxation

In monetary economies prior to fiat banking, a critical form of taxation was seigniorage, the tax on the creation of money.

Other obsolete forms of taxation include:

- Scutage - paid in lieu of military service; strictly speaking a commutation of a non-tax obligation rather than a tax as such, but functioning as a tax in practice

- Tallage - a tax on feudal dependents

- Tithe - a tax-like payment (one tenth of one's earnings or agricultural produce), paid to the Church (and thus too specific to be a tax in strict technical terms). This should not be confused with the modern practice of the same name which is normally voluntary, although churches have sought it forcefully at times.

- Aids - During feudal times a feudal aid was a type of tax or due paid by a vassal to his lord.

- Danegeld - medieval land tax originally raised to pay off raiding Danes and later used to fund military expenditures.

- Carucage - tax which replaced the danegeld in England.

- Tax Farming - the principle of assigning the responsibility for tax revenue collection to private citizens or groups.

Some principalities taxed windows, doors, or cabinets to reduce consumption of imported glass and hardware. Armoires, hutches, and wardrobes were employed to evade taxes on doors and cabinets. In extraordinary circumstances, taxes are also used to enforce public policy like congestion charge (to cut road traffic and encourage public transport) in London. In Tsarist Russia, taxes were clamped on beards. Today, one of the most complicated taxation-systems worldwide is in Germany. Three quarters of the world's taxation-literature refers to the German system. There are 118 laws, 185 forms, and 96,000 regulations, spending €3.7 billion to collect the income tax. Today, governments of advanced economies of EU, North America, and others rely more on direct taxes, while those of developing economies of India, Africa, and others rely more on indirect taxes.